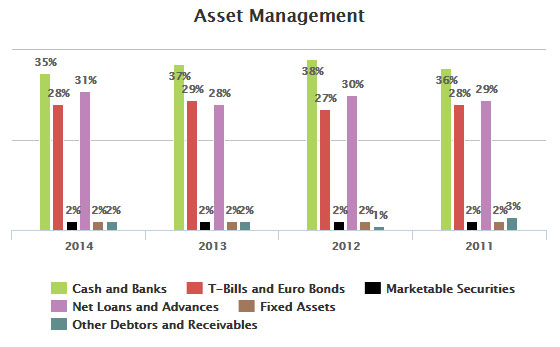

Profitability is the core of the enterprise performance management, as it presents the bottom line for every company.

Spacial Analysis

/ 2

/ 2

|

| SAR Id | Fraud Name | SAR Status | Primary Fraud Type | SAR Creation Date | SAR Due Date | SAR Date | SAR Filing Branch | |

|---|---|---|---|---|---|---|---|---|

| RR-2011-019758000 | Multiple transaction below CTR threshold | Reported Error | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 04/03/2017 | 09/03/2017 | BRANCH-0000 | |

| RR-2011-019758001 | Multiple transaction below CTR threshold | Draft | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 04/03/2017 | 09/03/2017 | BRANCH-0001 | |

| RR-2011-019758002 | Multiple transaction below CTR threshold | Reported E-File | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 04/03/2017 | 09/03/2017 | BRANCH-0002 | |

| RR-2011-019758003 | Multiple transaction below CTR threshold | Draft | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 01/03/2017 | 09/03/2017 | BRANCH-0003 | |

| RR-2011-019758004 | Multiple transaction below CTR threshold | Ready For Review | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 04/03/2017 | 09/03/2017 | BRANCH-0004 | |

| RR-2011-019758005 | Multiple transaction below CTR threshold | Reported Error | Fraud concerning Bank-wide activities and operations | 01/03/2017 | 04/03/2017 | 09/03/2017 | BRANCH-0005 |

SAR Details

Reports

- Monthly Statement of Assets and Liabilities

- Credit Facility Rating by Economic Sectors

- Notification about Debts due to be Written off

- Periodical Statement of Credit Concentrations

for a Single Customer and his Borrower Group - Periodical Statement of Credit Concentrations to a Single Customer

- Total of Overdrafts and Overdrawn Accounts

- Details of Other Overdrafts and Overdrawn Accounts Collateralized by Tangible Guarantees

- Assessment of Financial Investments Inside & Outside Qatar - All Banks

- Details of Balances and Movements of Financial Derivatives held for Trading or Hedging Purposes

- Details of Financial Derivatives for Hedging Purposes

- Details of Balances, Movements & Assessment of Financial Investments

- Calculation Form for Liquidity Ratio

- Calculation Form for Liquidity Ratio

- Form for Recording Fines for Violating Liquidity Ratio

- Calculation Form for Credit Ratio

- Calculation Form for Fines for Violating Credit Ratio

- Form for Recording Fines for Violating Credit Ratio

- Calculation Form for Ratio of Overdraft To Total Credit Facilities

- Form for Recording Fines for Violating Ratio of Overdraft To Total Credit Facilities

- Calculation Form for Total International Financing Ratio

- Form for Recording Fines for Violating Total International Financing Ratio

- Calculation Form for Ratio of Investments in Real Estate (Circulated Investments), Other Real Estate and Assets for purposes of (Trading/Leasing), and Real Estate for Bank’s Use

- Form for Recording Fines for Ratio of Investments in Real Estate (Circulated Investments), Other Real Estate and Assets for purposes of (Trading/Leasing)

- Form for Recording Fines for Violating Ratio of Assets in Foreign Currencies To Liabilities in Foreign Currencies

- Calculation Form for Ratio of Assets in Foreign Currencies To Liabilities in Foreign Currencies

- Scheduling Debt of a Member of the Bank's Board - Subject to Settlement

- Scheduling Debt of a Company Owned or Coowned by a Member of the Bank's Board - Subject to Settlement

- Monthly Statement of Assets & Liabilities (For Islamic Banks)

- Investments in Listed Securities for Trading (Islamic Banks)

- Fixed Continuous Investments in the Corporate Capital (Islamic Banks)

- Investments in Portfolios and Mutual Funds (Islamic Banks)

- Investments in Securities and Corporate Capitals (Islamic Banks)

- International Murabaha in Commodities & Metals (Islamic Banks)

- Other International Financing Operations (Islamic Banks)

- Investment in Real Estate for Trading (Islamic Banks)

- Investment in Real Estate & Other Long Term Assets for Leasing (Islamic Banks)

- Other Investments / Others (Islamic Banks)

- Other Assets & Liabilities (Islamic Banks)

- Private Investments (Provisioned) and their Sources of Financing (Islamic Banks)

- Monthly Statement of Assets and Liabilities

- Income and Expenses Statement of Banks

- (101) Cash and Precious Metals

- (102+104) Breakdown of balances maintained with QCB/banks/Other Financial Institutions According to Maturity

- (103) Breakdown of Securities Portfolio by Maturity

- (105) Breakdown of Credit Facilities by Maturity

- (105) Breakdown of Credit Facilities by Collaterals

- (105) Breakdown of Credit Facilities by Economic Sectors

- (105) Credit Classification According to Quality

- (105) Break down of Direct/Indirect Credit Facilities by Amount and Number of Customers (Non-Government)

- (106) Long-term Investment

- 107/01 Net Fixed Assets for Bank Use

- 107/02 Net Fixed Assets (for other purposes)

- 108- Breakdown of Other Assets

- (201, 202) Breakdown of Balances due to QCB/Banks and other Financial Institutions

- (203) Breakdown of Deposits as per Maturity and according to Sectors

- (203) Breakdown of Customer Deposits by Amount and Number of Customers (Non-Government)

- (207) Breakdown of Other Liabilities

- Profit and Loss Account

- The Depositors Share of Profits

New Accounts Opened KPI

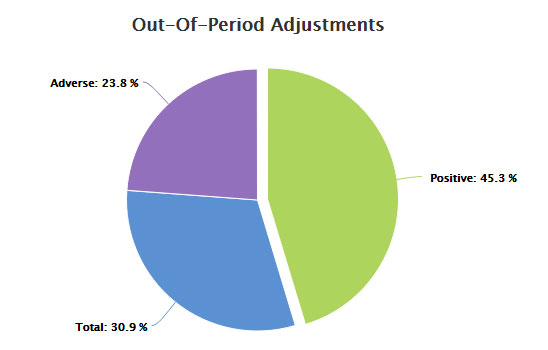

Revision Restatements: 25%

Out-of-Period adjustments: 37.02

Out-of-Period adjustments: 37.02

New Accounts Opened KPI

Total Income of Most Active Accounts

Rim Jalloul : 3,000,000 USD

Josephine Darakjy : 3,000,000 USD

Art Venere : 1,500,000 USD

17,746,700

USD

USD

Rim Jalloul : 3,000,000 USD

Josephine Darakjy : 3,000,000 USD

Art Venere : 1,500,000 USD

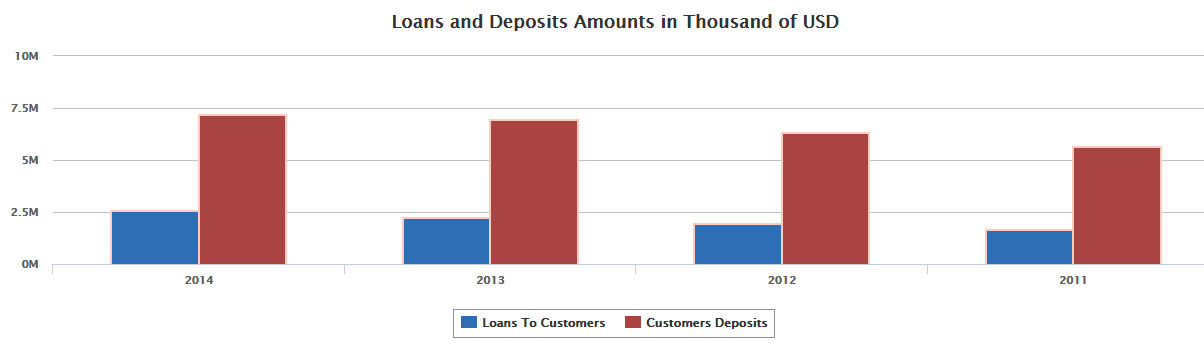

Loans and Deposits

Deposit type with the highest amount:

Time Savings Account:USD 4,020,823

Industry with the highest loan amount:

Retail: USD 1,065,477K

Time Savings Account:USD 4,020,823

Industry with the highest loan amount:

Retail: USD 1,065,477K

Inactive to Active Accounts

17 Accounts Reactivated

18% Belong to Ain El Mreisseh Branch

18 % Belong to Hazmieh Branch

24% Belong

To Achrafieh

To Achrafieh

18% Belong to Ain El Mreisseh Branch

18 % Belong to Hazmieh Branch

Customers To Be Verified

Interest Expenses on liabilities reached:

USD 306,267 K In 2014

USD 306,267 K In 2014

Customers To Be Verified

Customers to be Verified

29 Accounts Opened in August

18 Accounts Opened in July

7 Accounts Opened in June

54

Pending

Pending

29 Accounts Opened in August

18 Accounts Opened in July

7 Accounts Opened in June

Most Active Accounts KPI

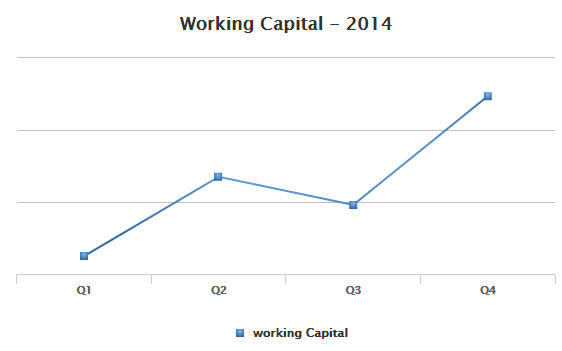

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Most Active Accounts KPI

Total Movement of Most Active Accounts

Hills Real Estate : 17,845,134 USD

International Wheelers : 9,658,741 USD

Rami Stephan : 4,821,014 USD

81,744,230

USD

USD

Hills Real Estate : 17,845,134 USD

International Wheelers : 9,658,741 USD

Rami Stephan : 4,821,014 USD

Profile Breaks

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Profile Breaks

Exempted from Reporting

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Exempted from Reporting

STR

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

STR

Over Limit Deposit per Client

Accounts Number

121212

123456

Continue Reading...

18.6% in

February

2017

February

2017

Accounts Number

121212

123456

Continue Reading...

Over Limit cash

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Suspicious Accounts

Reported Account for Suspicious Activity

1 Account belongs to Mazraa br.

1 Account belongs to Baabda br.

1 Account belongs to Tal br.

18.6% in

February

2017

February

2017

1 Account belongs to Mazraa br.

1 Account belongs to Baabda br.

1 Account belongs to Tal br.

Customer Relations and Group

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Customer Relations and Group

Reported Account for Suspicious Activity

1 Account belongs to Mazraa br.

1 Account belongs to Baabda br.

1 Account belongs to Tal br.

18.6% in

February

2017

February

2017

1 Account belongs to Mazraa br.

1 Account belongs to Baabda br.

1 Account belongs to Tal br.

Over Limit cash

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Over Limit cash

In February 2017

Alphonse Lebbos: 33,000 USD

Elie Ajami: 14,000 USD

Samir Hanna: 13,500 USD

534

transactions

transactions

Alphonse Lebbos: 33,000 USD

Elie Ajami: 14,000 USD

Samir Hanna: 13,500 USD

Avg Customer Risk Score 2016

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Avg Customer Risk Score 2016

Average Risk Score for 2016

32.0

5% increase from 2015

Highest Risk Score reported in Jan

Lowest Risk Score reported in Oct

32.0

5% increase from 2015

Highest Risk Score reported in Jan

Lowest Risk Score reported in Oct

Over Limit cash

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Housewife Unexplained Credit Account

2016 Transactions Amount $2,000,000

Top 3 Housewives:

Layla Warde: $300,000

Zeina Saad: $220.000

Continue Reading...

123 in

Transactions

Transactions

Top 3 Housewives:

Layla Warde: $300,000

Zeina Saad: $220.000

Continue Reading...

Number of Alerts

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Number of Alerts

Number of Alerts in 2016

6% increase from 2015

Highest Number of Alerts in Dec

Lowest Number of Alerts in Apr

1216

6% increase from 2015

Highest Number of Alerts in Dec

Lowest Number of Alerts in Apr

Suspicious Activity Reports

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Suspicious Activity Reports

Number of Alerts in 2017

Highest Number of Alerts in Hamra Branch

Lowest Number of Alerts in Awkar Branch

126

Highest Number of Alerts in Hamra Branch

Lowest Number of Alerts in Awkar Branch

Percentage of Cases in Backlog

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Percentage of Cases in Backlog

Total Cases Backlogged

6% increase from 2015

Highest Number of Alerts in Dec

Lowest Number of Alerts in Apr

53

6% increase from 2015

Highest Number of Alerts in Dec

Lowest Number of Alerts in Apr

Number of Alerts 2017

On December 2014

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

The Working Capital Reached:

Net Primary Liquidity Ratio Reached: 1.66

Net Secondary Liquidity Ratio Reached: 0.23

Number of Alerts 2017

Alert

Alert